Indian Stock Market App: Overcoming Common Mistakes in Traditional Share Trading

Traditional share trading in India has long been associated with certain common mistakes that investors often make. These mistakes can be costly and hinder the growth of investment portfolios. However, with the emergence of Indian stock market app, investors now have access to powerful tools and features that help them overcome these traditional trading mistakes. In this article, we will explore how Indian stock market apps are helping investors overcome these mistakes and achieve better trading outcomes.

Lack of Research: One of the most common mistakes in traditional share trading is the lack of proper research. Many investors jump into trades without thoroughly understanding the company, its financials, and the overall market conditions. Indian stock market apps provide users with a wide range of research tools and resources, such as company profiles, financial statements, analyst recommendations, and market news. These apps empower investors to make informed decisions by conducting thorough research and analysis before executing trades.

Emotional Trading: Emotional trading is another common mistake that can lead to poor investment decisions. Traditional share trading often involves the emotional rollercoaster of monitoring stock prices, which can lead to impulsive buying or selling decisions based on short-term market fluctuations. Indian stock market app provide users with features like price alerts and real-time market data. By setting price alerts and using the app’s analytical tools, investors can make rational decisions based on a more comprehensive view of the market, reducing the influence of emotions.

Lack of Diversification: Traditional share trading often falls victim to the lack of diversification, with investors putting all their eggs in one basket. Indian stock market apps offer users access to a wide range of investment options, including stocks, mutual funds, exchange-traded funds (ETFs), and more. These apps also provide tools to analyze and compare different investment opportunities, helping investors diversify their portfolios and reduce risk. By diversifying investments across various sectors and asset classes, investors can mitigate the impact of market volatility on their overall portfolio.

Limited Access to Market Information: In traditional share trading, investors often face challenges in accessing real-time market information, which can hinder their decision-making process. Indian stock market apps provide users with up-to-date market information, including stock prices, historical data, and market trends. With this information readily available, investors can make timely and well-informed trading decisions. Additionally, some apps offer features like market news updates and expert analysis, enhancing the accessibility of market information.

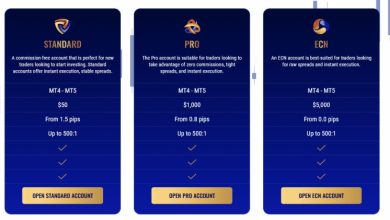

High Transaction Costs: Traditional share trading is often associated with high transaction costs, such as brokerage fees and taxes. These costs can eat into investors’ profits and discourage frequent trading. Indian stock market apps have disrupted this model by offering low-cost or even zero-cost trading options. With lower transaction costs, investors can actively manage their portfolios without being burdened by excessive fees, allowing them to maximize their returns.

Conclusion:

Indian stock market apps have emerged as game-changers in the investment landscape, helping investors overcome common mistakes associated with traditional share trading. By providing access to research tools, real-time market data, diversification opportunities, and lower transaction costs, these apps empower investors to make informed and rational investment decisions.